The sudden leap in UK inflation in February, coupled with turmoil within the world banking sector, leaves Financial institution of England charge setters going through a good more durable determination than traditional on Thursday.

The most recent knowledge, showing inflation at 10.4 per cent, has strengthened fears that worth rises are more and more being pushed by home pressures within the companies sector, relatively than the exterior shock of excessive vitality costs.

As a result of these pressures are typically extra persistent, the information has cemented market expectations that the BoE will elevate rates of interest once more.

However within the final fortnight, considerations over the health of the global banking sector have intensified. Though there isn’t a proof up to now of any UK-specific problem, and central banks preserve that monetary stability won’t get in the way in which of their inflation-fighting mandates, the tensions in monetary markets are more likely to make many banks extra cautious of lending. Different issues being equal, this would scale back the necessity for rate of interest will increase.

“The shock inflation rise final month will additional complicate the choice going through financial coverage committee members over what to do about rates of interest, as they grapple with turmoil within the banking sector,” mentioned James Smith, analysis director on the Decision Basis think-tank.

Among the shock rise in February’s inflation knowledge was on account of one-off elements such because the weather-related shortages of lettuce and cucumbers that led to empty cabinets in UK supermarkets and helped drive up costs of meals and non-alcoholic drinks at their quickest tempo for 45 years.

However worth rises had been broad-based, together with in sectors equivalent to hospitality, the place labour prices play a giant position. Annual companies inflation, thought-about a greater measure of home worth stress, accelerated to six.6 per cent. Within the hospitality sector, it rose to its highest charge on document.

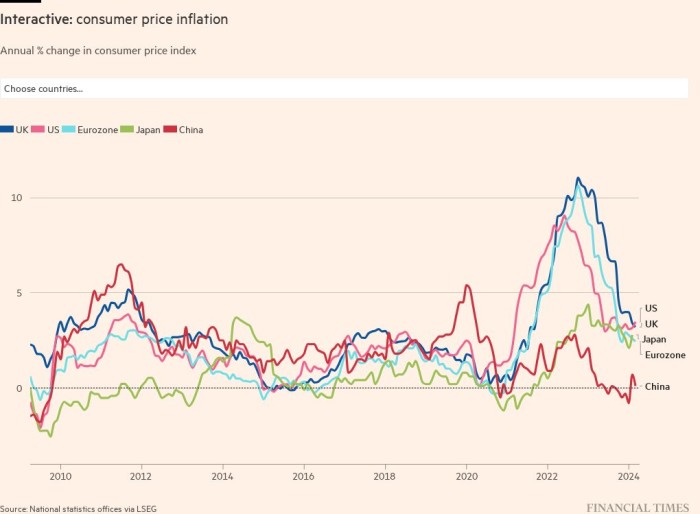

UK core inflation, which strips out unstable meals, vitality, alcohol and tobacco costs, rose sharply to six.2 per cent and it’s now 0.7 share factors greater than that of the US after broadly mirroring it for many of final yr.

The persevering with excessive ranges of inflation set the UK aside from different main economies. The speed has solely marginally slowed from a 41-year peak of 11.1 per cent final October, and the hole between Britain and the US and eurozone has widened.

The acceleration of core and companies inflation means that “there could also be extra domestically generated inflation stress than the Financial institution has assessed up to now”, mentioned Krishna Guha, economist on the funding financial institution advisory firm Evercore.

Kallum Pickering, economist at funding financial institution Berenberg, mentioned the BoE determination on Thursday “will hinge on whether or not policymakers imagine the backward-looking inflation shock is more likely to be the beginning of a pattern or whether or not it’s a one-off linked to regular month-to-month volatility”.

He famous that Wednesday’s knowledge got here after inflation slowed greater than anticipated in January and added that “warning nonetheless favours a maintain” by the BoE as a result of elevating charges earlier than the total influence of world financial coverage tightening has unfolded “dangers including to issues that may eclipse these related to extra inflation over the medium time period”.

With the UK housing market already reeling from the results of rising mortgage charges, “the danger is {that a} hike now might find yourself pushing inflation under goal additional down the road”, mentioned Susannah Streeter, head of cash and markets at Hargreaves Lansdown, a monetary companies firm

The considerations are that “the banking scare will find yourself being a disinflationary drive by resulting in a knock-on impact on lending which might hit the spending of corporations and customers if loans are a bit more durable to come back by”.

The BoE had been nearer to stopping growing charges than another main central financial institution earlier than the current banking turmoil, however markets now count on a 25 foundation level improve on Thursday.

This might be the eleventh consecutive charge improve since November 2021, with the central financial institution growing charges from 0.1 per cent by practically 400 foundation factors to 4 per cent in an effort to convey inflation all the way down to its 2 per cent goal.

UK vitality costs, which had been the primary driver of inflation for a lot of the previous yr, are actually falling however not by sufficient to offset the will increase in different gadgets. Costs of gas fell 1.3 per cent between January and February and the annual tempo slowed sharply to five.1 per cent final month, from a peak of 45.8 per cent in July 2022.

Regardless of the slowdown, UK vitality inflation stays a lot greater than within the US and the eurozone, reflecting the totally different stage of presidency help and the nation’s publicity to the worldwide vitality market.