The highest two crypto property have risen considerably previously seven days, with bitcoin leaping 22.6% and ethereum growing 18.6% in opposition to the U.S. greenback. In keeping with market information, each crypto property noticed the most important improve on Saturday, Jan. 14, 2023. The sudden spike in worth precipitated the best ratio of quick liquidations vs lengthy liquidations since July 2021, in response to a current Alpha report from Bitfinex.

Bitfinex Analysts See a Cautious Strategy From Bulls as Market Stays Extremely Illiquid Regardless of Worth Surge

Bitcoin (BTC) and ethereum (ETH) costs have risen considerably in opposition to the U.S. greenback, inflicting a cascade of quick liquidations on Jan. 14. The cryptocurrency change Bitfinex mentioned the matter in its most up-to-date Alpha report #37. When a dealer opens a brief place in opposition to bitcoin or ethereum, they anticipate the value of the crypto property to say no sooner or later.

Nonetheless, if bitcoin’s value climbs shortly, quick merchants both get liquidated or should purchase again the bitcoin at a better value. When the value of BTC or ETH rises an excessive amount of, quick sellers are liquidated, which means their quick place is closed by the crypto derivatives change. In keeping with Bitfinex researchers, a big variety of liquidations occurred on Jan. 14.

“Quick liquidations fueled all the improve in bitcoin and ethereum,” Bitfinex analysts mentioned within the Alpha report. “Quick liquidations at $450 million outweighed lengthy liquidations by a ratio of 4.5. On Jan. 14, the market noticed the best ratio of quick liquidations vs lengthy liquidations since July 2021,” the analysts added. In addition they talked about that the liquidation figures and quick vs lengthy liquidation ratio was much more extreme amongst altcoins.

Bitfinex analysts additional detailed {that a} retraction in bitcoin’s value nonetheless stays possible. “Whereas it’s typical for bear markets to have an entire wipeout of shorts,” the analyst famous. “Your complete rally has been constructed on the spine of steady market shorts retaining funding low and costs being pushed up by pressured liquidations and working stops. So, a pullback in bitcoin value stays a risk.”

The Alpha report provides:

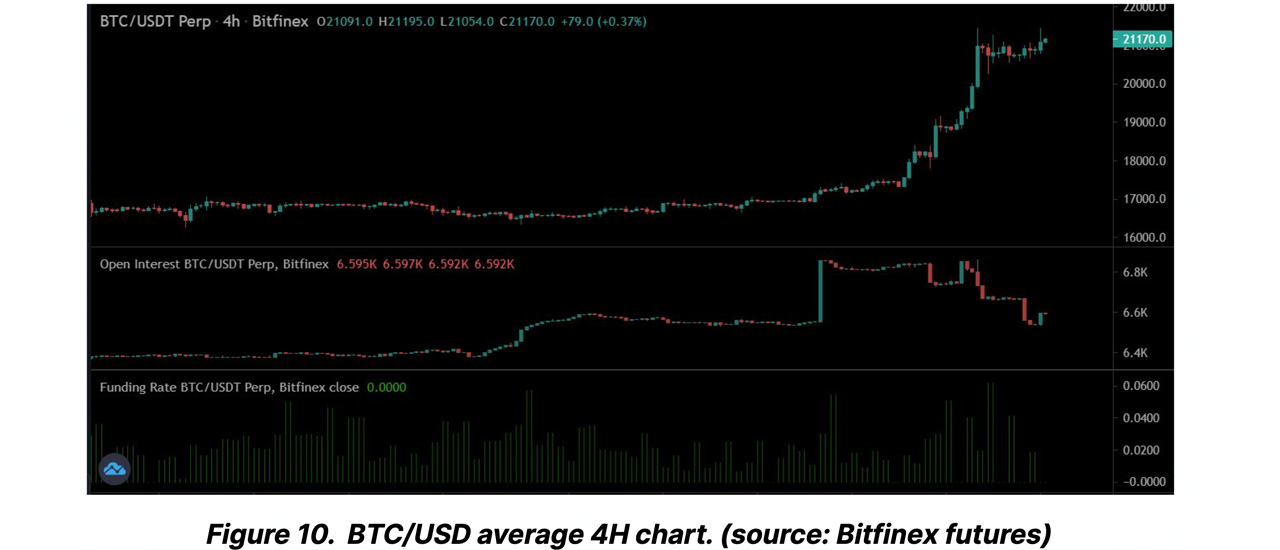

Though the transfer is perhaps interpreted as natural, it’s completely engineered by restricted merchants available in the market, which is clear from the market depth remaining the identical week-on-week. The value influence from market orders can be the identical as final week for [bitcoin], and there may be little change for altcoins. Which means even with the leg up, the market stays extremely illiquid, and with the sharp fall in open curiosity over the weekend, a pullback is perhaps anticipated with a cautious strategy from bulls.

Crypto Supporters Debate the Gartner Hype Cycle Place and ‘Disbelief’ Section

When the liquidations occurred three days in the past, Bitfinex reported that Bybit skilled the most important quick open curiosity wipeout since its inception. “The detrimental funding charges beneath $16,000, adopted by growing aggregated long-side open curiosity for [bitcoin], had been the driving power behind the value surge,” the researchers defined.

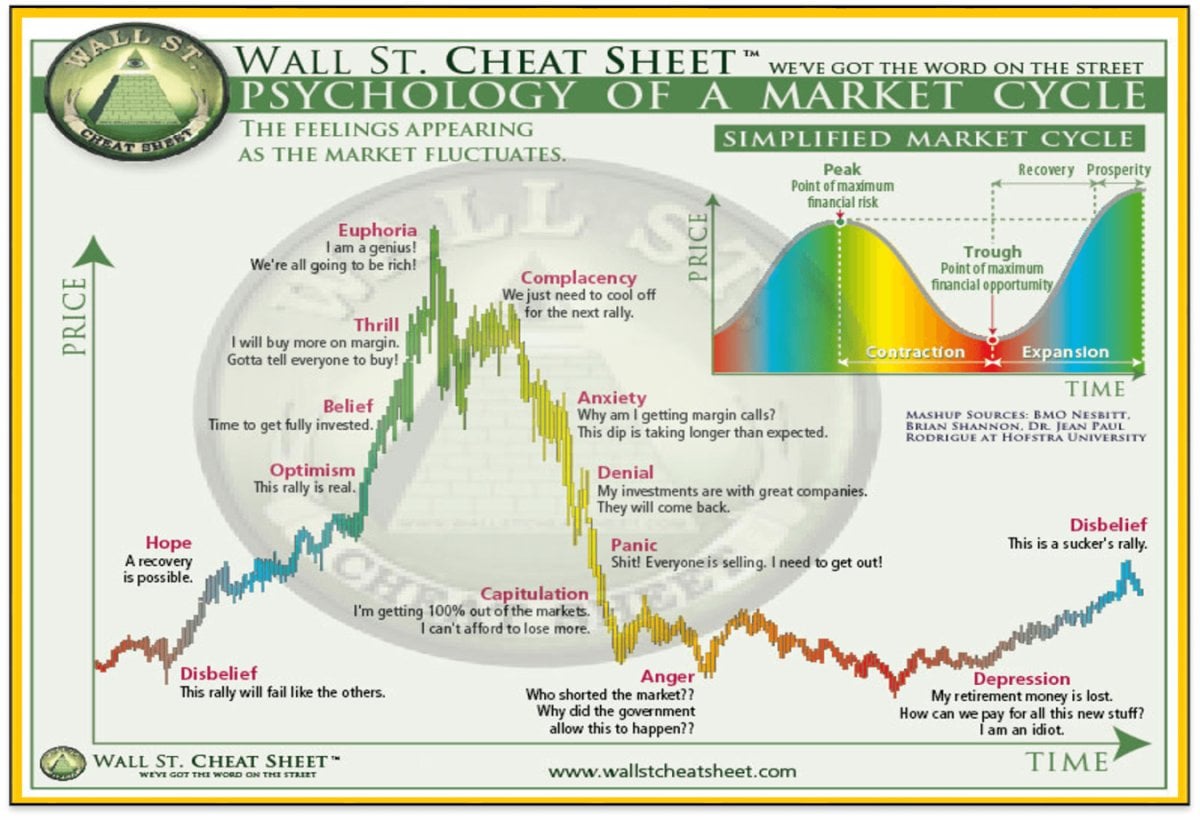

The current rise in bitcoin and ethereum costs has precipitated many individuals to invest whether or not the crypto backside is in. On Jan. 16, 2023, bitcoin analyst Willy Woo shared an illustrated picture of the Gartner Hype Cycle and said, “I think we’re within the ‘disbelief’ part of the cycle.”

A lot of individuals disagreed with Woo’s opinion about being within the ‘disbelief’ part of the cycle. Crypto proponent “Colin Talks Crypto” replied to Woo, saying, “No approach.” Colin additional pressured that it will “imply the standard bear market received massively shortened, (which is very unlikely, particularly in as we speak’s poor macro local weather).” The crypto supporter and Youtuber added:

It could imply a bitcoin 4-year cycle in some way magically grew to become a 2-year cycle or one thing.

What do you consider the Bitfinex Alpha report and the quick liquidations that occurred this week? Do you assume we’re within the ‘disbelief’ part of the Gartner Hype Cycle? Tell us what you consider this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons