Few will remorse the passing of 2022. It has seen a brutal onslaught on a peaceable neighbour by a vile despot. It has seen hovering inflation and falling actual incomes in a world “cost-of-living” disaster. It has seen rising rates of interest, a robust greenback and widespread difficulties over debt: based on the IMF, 60 per cent of low-income countries are in debt distress or at high risk of being so.

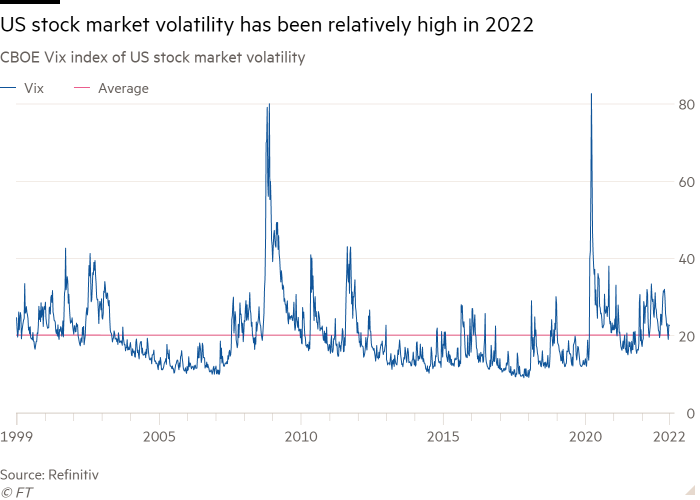

It has seen falling asset costs and heightened volatility in markets. It has seen necessary strikes in the direction of uncoupling between the US and China and the formation of competing blocs centred on the 2 superpowers, with Russia firmly in China’s camp. It has seen the failure of the COP27 conference to bend the curve of emissions of greenhouse gases downwards. It has not even seen full restoration from the dire outcomes of the Covid pandemic, especially among the world’s poorest people.

That is dangerous. Worse should still be to come back, presumably even a lot worse. Vladimir Putin, particularly, is an unknowable amount. So, too, as we have now seen over his coverage in the direction of Covid, is Xi Jinping. Who is aware of what monetary mayhem the Republicans may unleash over the US debt ceiling in 2023? Once more, will the EU actually keep the course on Ukraine as rates of interest rise, economies fall into recession and debt misery will increase?

But it’s not all dangerous. In 2022, mild additionally shone within the gloom. Allow us to have fun this earlier than we plunge into a brand new 12 months.

The west is again. The invasion of Ukraine has introduced those that share democratic values collectively. For the Nato alliance, it was a time of rebirth. For Germany, it was a Zeitenwende. For Finland and Sweden, it was time to reject neutrality. Donald Trump’s fawning over Putin did not undermine US assist for Ukraine. Volodymyr Zelenskyy gained the propaganda battle, arms down. He’s the heroic leader Ukraine — and the west — so desperately wanted.

Putin shouldn’t be the only strongman to look weaker today than a year ago. So, too, do Xi and Trump. The previous’s zero-Covid policy has resulted in ignominy. The declare of right this moment’s model of historic Chinese language despotism to rule extra competently than messy democracy lies in tatters. Iran’s despots are under assault from their younger. Trump’s candidates were substantially repudiated within the midterm elections. Sure, he has vastly too many supporters for consolation. The Republican elite stays craven. However Congress has now made his attempted insurrection as plain as day.

In the meantime, in battered Britain, the worth of democracy has additionally been confirmed. Moved by fears of electoral defeat, the Conservatives ditched Boris Johnson, adopted by the staggeringly incompetent Liz Truss in 44 days. Nobody died. Democracy shouldn’t be excellent, particularly when it takes the type of referendums on matters the folks can’t be anticipated to grasp in full. However they do study: a current YouGov poll reveals 51 per cent regretting Brexit and a mere 34 per cent nonetheless supporting it. This shift will permit a future authorities to convey the UK nearer to the EU once more.

Too late, however with willpower, the Federal Reserve has acted to convey home inflationary pressures below management within the US, the place they have been strongest. Partly in consequence, inflation expectations stay below management. Ache continues to be to come back. However the likelihood is good that inflation can be introduced below management within the US and elsewhere in 2023. A return to progress ought to comply with.

Rising nominal and actual rates of interest have shaken the markets. The cyclically adjusted value/earnings ratio within the S&P 500 has fallen from 39 in December 2021, the second-highest peak in historical past, to a current low of 27. That’s nonetheless far above the long-term common of 17. However it’s a transfer in the direction of actuality. Markets have additionally grow to be noticeably extra risky and a few speculative property have tumbled badly. Bitcoin is down from a peak of $69,000 final 12 months to $17,000. This proves that it’s neither a unit of account nor a retailer of worth. It has by no means been a helpful technique of cost. As went Bitcoin, so went Sam Bankman-Fried’s FTX. Rates of interest could not keep excessive in actual or nominal phrases. However their jumps have reminded buyers of danger. Good.

Globalisation can also be not useless. Certainly, outdoors the US, the place whining about unfair commerce has grow to be virtually epidemic, most international locations perceive that they want buoyant commerce to thrive. Encouragingly, the IMF forecasts the amount of world commerce in items and companies to rise by 4.3 per cent this 12 months. Apparently, that is sooner than the two.9 per cent progress in commerce in items: commerce in companies is taking the lead. This follows 10.1 per cent progress within the quantity of commerce in items and companies and 10.8 per cent progress in commerce in items in 2021. In the meantime, world gross home product is forecast to develop solely 3.2 per cent in 2022, after 6 per cent in 2021.

So, the world shouldn’t be deglobalising: commerce is simply not rising as quick as earlier than. That’s partially a pure improvement. Globalisation couldn’t develop as quick as earlier than. However it’s nonetheless at work. The world economic system additionally continues to develop. Our ancestors would discover this extraordinary.

Lastly, in a messy and ill-co-ordinated method the world is leaving Covid behind. That is tremendously helped by the vaccines, despite the fact that these should not as broadly distributed as they need to be. Worse variants are doubtless and new pandemics possible. However that is progress.

It’s simple to be overwhelmed by the risks, injustices, conflicts and failures of our world. Absolutely, sufficient of them exist. However not all that occurred this 12 months was a catastrophe. For these of us who consider in democracy, the rule of legislation, continued financial advance, world financial integration, sound monetary markets and financial stability, 2022 was not solely dangerous. But allow us to hope that 2023 is best. It must be.