There was no sugar coating the horrible financial forecasts within the Autumn Assertion. With a traditionally massive drop in UK family incomes, falling actual wages and a sizeable recession — all compounded by a brand new squeeze on public providers and better taxes — Jeremy Hunt had little excellent news to spotlight.

Though the chancellor skated over the worst predictions for Britain’s economic system, he revealed simply how a lot he was boxed in by the necessity to impose the most important budgetary squeeze since 2010.

However Hunt was prepared to simply accept horrible financial and public finance forecasts, in distinction with Kwasi Kwarteng, his predecessor, who ignored the Workplace for Finances Duty, the fiscal watchdog, and was crucified by monetary markets.

The depressing outlook stems from Russia’s invasion of Ukraine pushing up wholesale vitality costs to eight instances above regular ranges. This squeezes actual incomes of households by 7.1 per cent by 2023-24 and in addition undermines the monetary efficiency of corporations and the federal government. There may be little shock that the economic system has been pushed right into a recession that can final via to the top of subsequent yr.

The next restoration is forecast to be notably lacklustre, however right here the worldwide scenario is much less guilty than the UK’s home weak point.

In 5 years’ time the OBR expects the economic system to be 3.7 per cent smaller than it thought possible as just lately as March — an enormous downgrade in financial efficiency. This implies the economic system won’t have grown in any respect between the final election in 2019 and the following one, if is known as on the finish of 2024.

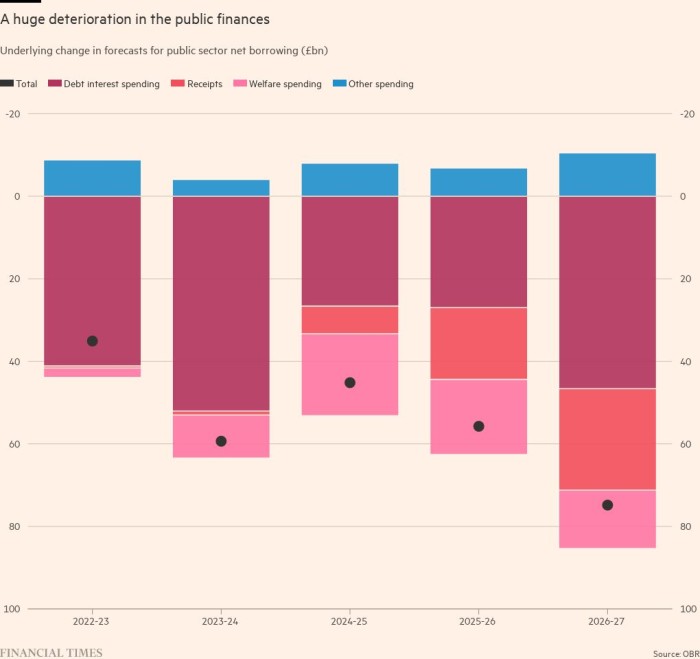

The persistently feeble economic system coupled with a lot greater prices of presidency borrowing because of excessive inflation has blown aside the UK’s public funds. Within the forecasts Hunt was introduced with forward of the Autumn Assertion, the underlying authorities deficit was revised greater from £31.6bn to £106.4bn in 2026-27 on the again of upper predicted prices of servicing authorities debt, greater welfare spending because of persistent inflation and weaker tax receipts.

The OBR additionally advised Hunt he was not on observe to fulfill any of the federal government’s current fiscal guidelines. Even when he loosened them — to make them simpler to hit by measuring debt and deficits in 2027-28 fairly than 2025-26 — the watchdog nonetheless reckoned the general public funds weren’t sustainable. Public debt would nonetheless be rising as a share of gross home product within the forecasts, even by 2027-28, and public borrowing was greater than 3 per cent of GDP.

Inevitably, that meant a budgetary consolidation was wanted. Hunt bit the bullet and imposed £55bn of spending cuts and tax rises in his Autumn Assertion, with cuts to day-to-day spending on public providers and capital funding, and tax will increase.

The timing of the measures differ. Spending cuts, which rise to £30bn a yr, are delayed till the recession is forecast to be over. For the following yr, the federal government is about to help the economic system with its vitality value assure and a few funding for colleges and hospitals.

Tax rises are coming earlier, nevertheless, with £7bn of income elevating measures coming as quickly as April, after which rising steadily to boost £25bn a yr by 2027-28.

The tax will increase are largely being imposed via stealth measures that freeze tax allowances and thresholds, making certain that as incomes, spending and income rise, a higher slice of them shall be taxed or topic to greater charges of tax.

Whilst Hunt introduced the biggest budgetary squeeze since 2010, the OBR mentioned he had not been as prudent as former chancellors in constructing resilience into the general public funds.

“This chancellor has left himself comparatively little headroom in opposition to his proposed new fiscal targets relative to earlier chancellors,” it mentioned in its report.

The federal government is hoping that pure fuel costs will fall and the Financial institution of England won’t have to boost rates of interest as a lot because the OBR has pencilled in to its forecasts. If that occurs the outlook shall be significantly brighter and a few of the tax will increase and public spending cuts may show pointless.

However this will effectively show to be wishful pondering. The Autumn Assertion revealed that the UK’s financial efficiency is more likely to be far — and persistently — worse than forecasts printed in March.

Downgrades of this scale are very uncommon and, it seems, extraordinarily disagreeable for any chancellor — and for the nation.